How to raise the first money

Raising the first money is always hard. Also for senior executives and those founders who make it look easy.

When raising the first round, what matters is the quality of the insights and story, and the discipline to run the full process like an auction, even for the pre-seed round. A structured process is a superpower.

Run the process as an auction, and have one founder fundraising full-time. You will close the pre-seed in 4-6 weeks. Don’t build and fundraise simultaneously. It will drag the round for months, and you will neglect the business more. Also, a round that drags too long may send negative signals to other VCs. So, just focus on one thing, run the process, and return to build quickly.

—

The objective: raise quickly and just enough

If you look to raise your pre-seed or seed, (1) raise just enough money to validate your insights and customer adoption. You need to raise to search (your PMF), not to scale. And, (2) fundraise quickly to return building.

Be careful about raising too much too early. Maybe for ego or security. This increases expectations and the risk of driving into quick but low-quality revenue

Set the valuation: investors’ quality and dilution

Think about your valuation as the function of how much money you need and the dilution you accept.

Dilution matters, but there are also benefits to avoiding an overly expensive valuation.

The quality of investors is also key. And, it’s a long-term relationship that you can’t undo. Don’t lose a great investor over small dilution.

(1) Raise enough to validate and add a buffer

The cost to build the first product often ranges from $250k to $1m per year for a small team of engineers and the founders. Then add a buffer: 12 months of runway in good times, 18 in downturns. Start the Series A with this 12 to 18-month buffer to reduce pressure. It takes time to raise.

(2) Dilution: own > 51% post-Series A

Rule of thumb. After Series A, founders should keep 51-60%. Model dilution early: 20-25% across pre-seed & seed, and another 20-25% at Series A is usually enough.

Important. Raising multiple seeds with SAFEs only dilutes founders, not investors. This is because SAFEs aren’t shares. Founders don’t realize this until it’s too late. Apply this to your model.

(3) Valuation: optimize for investors’ quality, then for dilution

The calculation is simple. If you need 20% dilution and $2m to prove your insights with a buffer, then the valuation post-money is $10m.

Some valuation benchmarks at pre-seed are:

- Val. of $5-8M for first-time founders

- Val. of $7-12M for senior execs or repeat founders.

- There are always exceptions. And, YC and seed+/pre-A price is higher.

Some investors aren’t price-sensitive. Others cap pre-seed at $8-10, with a few exceptions available each year. Don’t lose a great investor over small dilution.

How to create the process 🍀

1. Prepare the materials (2-4 weeks)

Prepare materials upfront. You won’t have time once the pitching starts.

At this stage, an idea and a solid deck are enough. I like adding some materials to show our thinking and to react quickly if asked. Those are:

- Make a simple story: have clarity on the why now (the market), why us (the team), why this pain point (the problem), early sign of PFM, your unfair advantages. And, what are the reasons to invest and not invest?

- One-liner & blurb: key for intros. First impressions matter. They’re hard to change later.

- Deck: 6–10 slides. Avoid misconceptions of each slide. Stand out from the crowd.

- Data room: Not required at this stage, but good to have it ready. Include backup slides, customer insights, the Excel model (for your reasoning, not projections), and legal documents.

- Know your investor: study the investor before the call.

Creating a concise and compelling story is really hard. Iterate a lot. Ask senior founders and your investors to review it.

2. Create the pipeline: start with 50-100 qualified leads (~1 week) 🍀

Ask intros only to qualified investors. Do it by stage, sector, geo, and competitor fit. Use ChatGPT, their website, founders, and angels. Qualifying is key. VCs that invest were already convinced of the space. Those needing conviction rarely invest.

Get some notable angels. They can provide great help. Their brand creates social proof and strong introductions. They can also connect in parallel with the VCs you’re pitching to and create FOMO for you. Target three types of angels:

- Experienced founders are the best. They offer great support and the warmest intros

- Tier 1 angels and GPs (investing personally)

- Senior executives of the Tier 1 incumbents in your space.

3. Get warm intros from founders (~1 week)

Warm intros beat cold ones by a large margin. Portfolio founders’ intros beat VCs’ intros.

Ask founders. Founders help each other. Build a network, if you are starting. It shows resourcefulness.

Ask each new investor for one intro. It’s an easy ask and usually their best. Never ask those who have passed or are undecided.

4. The structure of the first call

See below how I structure my first call. And, I don’t present the deck during the call. It distracts and breaks the story’s flow. I share it before or after.

Step 1: Investor intro and Q&A (5 min): understand the investor’s propensity to invest.

Let the investor introduce themselves for 5 minutes. I record these notes in my investor tracker. Ask their investment stage, ticket size, and lead/follow. Inquire about their timeline, internal process, and yearly investment count. A few recent deals usually mean a low probability of investing. For example: 2-4 investments per year equals low propensity; 1 per month is medium-high. Use the Q&A to understand the mutual fit.

Step 2: Founder intro, no Q&A (5 min): convey your strengths; ensure everyone is aligned.

The goal is to ensure the investor has a full understanding of your story and strengths. Ask for 5-10 minutes uninterrupted to present your story. Early interruptions derail the flow and have irrelevant questions. Protect the narrative and ensure the message sent is the one received. It’s often not the case.

Step 3: Founder’s Q&A (20 minutes): convey momentum, be prioritized.

Use their questions about your round (amount, valuation, allocation left, investors already in) to signal momentum. Investors avoid cold rounds but feel the FOMO in hot ones. Don’t oversell and lie (obviously). Share your timeline and momentum. This helps investors prioritize you with partners and the next IC.

5. The timeline: keep a tight timeline with investors racing in parallel (4-7 weeks) 🍀

Set a tight timeline. It is one of the best ways to create leverage and momentum. Compress meetings so investors feel they’re racing.

Interestingly enough, a tight timeline also helps investors decide. It forces internal consensus and avoids procrastination. The more time investors have, the less decisive they become.

Below the founders’ timeline and phases:

- Week 0: Train your pitch with other founders or existing investors.

- Week 0: Get 50-100 intros, book the slots.

- Week 1: First calls (4–5 per day)

- Week 2: First and some second calls

- Week 3: Second Calls

- Weeks 3-5: Q&As and DD: receive questions from interested investors.

- Weeks 5–7: Receive feedback and decisions.

As you can see, there is no time to prepare the data room. Finish it before the round starts.

The investors’ timeline at pre-seed/seed:

- Angels decide within 48 to 72 hours from the first call.

- Pre-seed funds will be decided in 1 to 2 weeks.

- Larger seed rounds follow the standard of 4-7 weeks

How to follow up:

- Ignore the slow and undecided ones. Experienced investors know they must act quickly. If VCs are ghosting or taking their time, they likely aren’t interested.

- Don’t over-follow up. It signals a slow round. I follow up twice. First, I sent a longer deck after a week with some good news. Then a short update showing progress in the round and in the business. “We have 30% allocation left” and “We just grew 40% MoM” is effective.

6. Select your investors

Ensure a personal fit with the specific partner, not the firm. The VC’s brand helps. Run reference checks. Ask about how they act in complex and high pressure situations. And during disagreements. Be mindful, it’s a long-term relationship. You cannot fire your investor.

7. The closing: SAFE on a rolling basis

SAFE only at this stage. I like to keep all investors on the same terms. No side letters or special terms. Confirm all the key terms by email. Then e-sign instantly.

Important:

(1) Sign SAFEs on a rolling basis, right after the confirmation of each single investor. Not all after you find the lead, that is harder. This is not a priced round (e.g. series A). So, don’t give away this big leverage. Investors don’t like this. It reduces the allocation available and increases pressure

(2) Raising multiple seeds with SAFEs only dilutes founders, not investors. This is because SAFEs aren’t shares. Founders don’t realize this until it’s too late.

How to create momentum 🍀

Create the right momentum and let the process drive it for you. So you stay credible without overselling or playing the bad cop.

The right momentum and FOMO are created by a compelling story, product, and a competitive round. Investors will naturally want to be a part of your journey. Do not oversell and overplay tactics.

Before starting, keep in mind these two dynamics:

(1) VCs don’t buy metrics. They buy the story about the future, and if you have extreme strengths in the right areas. Their focus is 70% on the future, 30% on past data. Then, they look for outlier strengths, not for the lack of weaknesses. “If you don’t invest due to serious flaws, you don’t invest in most of the big winners” – pmarca. You definitely need compelling data to support the story. But finally, “90% of an investor’s decision is based on emotions and narratives. Reasoning comes later to explain a decision to invest or not invest” – KV

(2) Momentum and FOMO help VCs decide. Without FOMO, interested VCs might pass. Some pass from “fear of looking stupid” investing alone or first. Other VCs don’t need external validation, but will also test founders’ ability to fundraise in the future

To address each points, I like to:

(1) The story: Spend enough time creating a compelling and well-thought-out story. It might take a few weeks to summarize and compress the insights learned over the years or months

(2) The momentum: I build a process that creates competition and urgency for me. I play the good cop: energetic, high conviction yet calm and professional. And my process plays the bad cop to drive momentum. A well designed process becomes an F1 race or an auction

Below are some tactics that might help create competition and urgency:

Create competition:

(1) (Priority 1) Start with a large pipeline of qualified investors. 50 seems fair, 100 is better. Increase your pipeline: after signing, ask investors for only one quality intro. It works great

(2) (Priority 1) Create scarcity: “Use the small guys to put pressure on the big guys.” Sign a few small investors first to build scarcity and momentum. But keep space for a big VC needing 10-15% ownership. You don’t need a lead investor at pre-seed and seed. Use this leverage!

(3) (Priority 1) Create scarcity: Use rolling SAFEs always. Close angels early to show momentum and validation. E-sign them as they confirm. Communicate limited space: “We only have 30% left in the round” is more powerful than “we’re raising $1m”

4) Keep VCs moving in parallel. Avoid some racing ahead while your preferred ones are behind

Create urgency:

(1) (Priority 1) Show inevitability: project conviction, confidence, and energy. Make the company’s progress look unstoppable, with or without them

(2) (Priority 1) A compressed timeline. Align all VCs at the starting line. It’s an “F1 race.” Control your race. Also, a slow timeline lets VCs align, gauge momentum, and rarely collude

(3) Share the timeline smartly. Let them know they are in a competitive race or auction. “We have 40 meetings, and we’re adding a few more”

(4) Don’t give too much visibility. Be selective about what you share. Especially when asked who is looking at your round or has passed, and how the progress is. If the round looks slow, they may withdraw

(5) Social proof: sign well-known and strategic angels and a notable pre-seed investor. It helps

(6) (Sustain urgency) Use existing angels to “casually” mention that the round is moving fast or provide great references to investors. It’s just a simple tactic, but it might help

(7) (Sustain urgency) Share good news in your follow-up emails. Say, “The round is moving, in fact…” and “The business is moving well. We just grew 40% MoM.” This creates urgency. Drop it casually in a follow-up email or during a subsequent call

Don’ts:

(1) (Priority 1) You don’t need a lead investor at pre-seed or seed. Low conviction VCs ask for a lead to help them think. At this stage, rounds often close with small and medium checks, and maybe one or two institutional VCs. On the contrary, for Series A onward, you need to secure a lead first, which is harder

(2) (Priority 1) Don’t artificially create pressure and unrealistic timelines. Investors need their process. Just ensure you are their priority

(3) Don’t oversell. Don’t trigger the bullshit meter. Don’t pitch like you’re selling a pen or insurance. Instead, it’s more like a lesson teaching investors about your non-obvious secrets. Keep the conversation simple, and focus on what matters the most.

(4) Don’t overplay tactics. They’ll feel fake and turn VCs off. The aim is to show competition while building long-term relationships. Some investors might invest now, others might invest in the future.

(5) No intros from investors who passed or are undecided. It never works

(6) No “early look.” Everyone must be aligned at the starting line of your F1 race. VCs with early access or many pre-coffees rarely invest. They have no FOMO. Save time and talk to VCs only when the round is starting. Not when you are building the product.

(7) Don’t over-follow up. VCs move really fast when interested. They know the game. I follow up twice. If they vanish for 2 weeks, they aren’t interested

(8) Never screw anyone over, and don’t be arrogant. Verbal commitments have value.

(9) Don’t claim things that are not true or not completely finalized. “We are at the final stages with a few investors and might add a few more soon” is significantly better than saying you received an offer when you did not. It backfires in many ways

(10) I personally don’t like to offer better terms to early investors inside the same round. It shows you needed help to create momentum, and gives a bad taste to those investors who are only a few weeks behind

Latly, don’t love raising more than building. A strong product attracts investors more than pitching skills

Ultimately, fundraising tactics can be helpful. However, the best magnet is still a great product and a compelling story

Understand VCs’ timeline and dynamics

Win VCs’ attention

As discussed, the founder’s goals at this stage are to raise enough to validate insights with an extra an 18-month buffer. And, to raise quickly to go back to building.

The goals of a VC are to invest in outlier outcomes and don’t waste time with good or mediocre startups. First, VCs don’t invest in good startups; they seek outliers ones. With a simple example: They expect your company to reach around a $10B market cap in 10 years. A 10% stake in your company must return them $1B, assuming a ~$250M fund. A smaller fund requires smaller outcomes. Or same large outcome but a smaller % ownership. Second, VCs can’t waste time on good startups. They must focus on potential greats. Their days are packed. Back-to-back pitches (5-10 per day), writing memos (2-3 hours per day), and team syncs. For GPs, fundraising from LPs takes an additional 50-80% of their time.

To win VCs’ attention, you need a concise and sharp blurb, one-liner, and pitch deck. Show why your startup is different. Stand out from the crowd. Then deliver with a smart, high-energy presence that stands out after their tenth call.

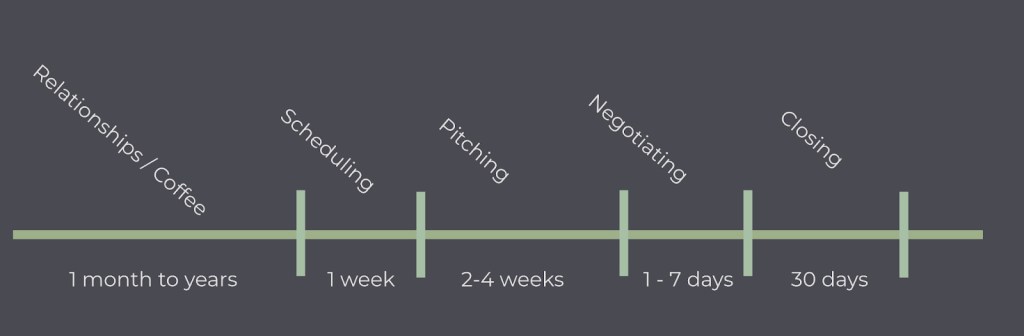

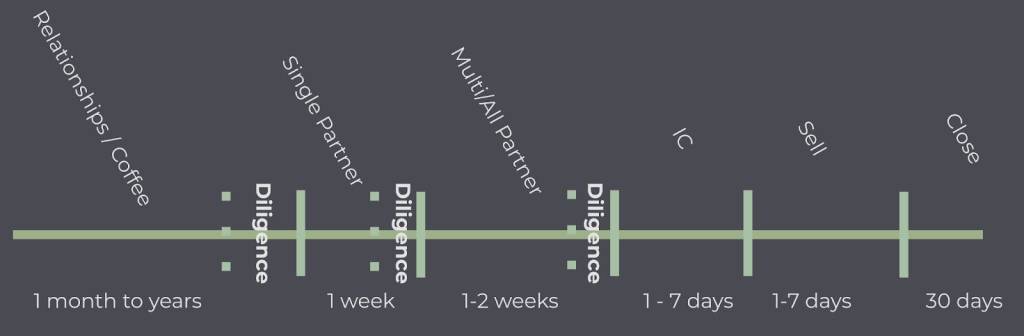

The founder vs. the investor timelines

Find below two interesting slides by Aaron Harris’s post “Always run an auction” (read it). The slides show the founders’ and VCs’ timelines.

Note that pre-seed and smaller VCs usually decide faster within 2-10 days. They need to act before the tier 1 VCs step in.

As you can see, larger VCs have a weekly cadence. On Monday, investors meet to talk about their deals in the investment committee (IC). After the IC, and if there is interest, the investors will ask the founders new questions and data. Then the new answers will be discussed the following week. Ask on which day the VCs hold the IC. It helps you time their behaviours.

The founder timeline:

The investor timeline: weekly cycles with check-ins on the Monday IC

Understand VCs’ internal dynamics and roles

When you pitch, you’re not just talking to a VC. You’re entering a small organization with its own internal dynamics and roles.

Smaller or pre-seed VCs:

Usually made of GPs only. The founders talk directly with the decision makers. They decide quickly. Focus on them when raising the pre-seed

Larger VCs at seed and series A onward:

Associates often source and screen deals

Principals push promising ones forward

Partners (junior/associate) and GPs make the final decisions

They debate your company and ask for clarifications during the investment committees (IC)

Understand their hidden concerns and roles – the gatekeeper, your champion, and the real decision maker. This helps tailor your message.

Also, founders’ words often get reshaped by all the parties before the IC. Keep your story simple and clear, and help the Principal carry it through.

The common rejections:

Good VCs know how to say “no” well as this happens ~99% of the time. However, there are may type of rejections and VCs:

The teacher: a direct no with an explanation

Some VCs give detailed rejections. It’s time-consuming and risky for them. Founders may take offense and argue, hoping to change their minds. I personally learned a lot from them even if told verbally

The sniper: a direct no

Other VCs say no without a reason. I still appreciate the effective approach

The waiting list: a soft no

Phrases like “come back after more traction,” “let’s stay in touch”, “too early for us”, “we’d love to see more metrics/customers/revenue first” all indicate the same thing. VCs don’t see an outlier potential now, but still want front-row access if that changes, obviously

The Hamlet: indecision

Interested VCs move fast. Procrastination signals a poor decision-making process or a tactic to use time to negotiate and put pressure. It rarely ends in an investment. If it does, it’s often a lowball. I find those VCs funny. And ultimately, you want investors with high conviction

The ghost

Some VCs just disappear. Assume a deal is lost if there’s no reply within two weeks

The funny one

It’s always fun to hear from founders how diverse and creative VC rejections can be.

I’ve had an email rejection six months after our last call, and with the round successfully closed

A list of pre-seed investors: good and quick

I selected below a list of investros that are pre-seed, decide quickly and have a high propensity to invest. I can connect with most of them.

Global:

- Just apply to YC. Read here how to apply

- HustleFund: the best, a must have

- 500

- Alan: the top-rated in YC’s investor platform

- Huey is a great angel to have (APAC, global)

- Fortwest: Fintech. Ray is an ex Ribbit

- Spice: Fintech. Nick is an ex Ribbit

- Crestone: Fintech in EMs

- Hummingbird

- Fluent

- 468 ventures

- Picus

- FEBE: Nicolas is great

- Soma Capital: US and EMs

- EveryWhere VC: pre seed, global

- Outside VC

- Kadan: APAC, Japan, Global

Asia:

- Ratio: APAC, India. Alex is fantastic. Must have!

- XA network: APAC, ANZ, Africa, and more cities to come. A well known angel network

- Iterative: APAC. Brian is great. They can invest outside the program as well

- Arya: Indonesia, global. A super angel and a great person

- Kopital: Indonesia and APAC. A must have if in Indonesia or APAC

- Cocoon Capital: APAC, Enterprise, DeepTech

- Wing: APAC

Some additional investors lists:

1. A list o pre-seed investors open to cold outreach here

2. Octopus Ventures: Europe. Health, Fintech, Deeptech, Consumer, B2B software. $100k

3. Fuel Ventures: Europe. SaaS, Marketplaces, Fintech, eCommerce. $250k (pre-seed)

4. ROI Ventures: Europe. B2B. $50–100k (pre-seed)

5. Arka Venture Labs: US & India. AI & Deeptech. $200–500k

6. Susa Ventures: Global, pre‑seed and seed, software + AI

7. Ventech: Europe, 1/2 vertical AI and 1/2 digital health and industrial software

8. Angular Ventures: Europe, pre seed, deep tech

9. Precursor: US, Global. Generalist pre‑seed

10. Day 1: Europe, Central Eastern Europe, pre-seed

11. Araya Ventures: Europe, pre seed, B2B SaaS and consumer

12. BlackWood: Europe, pre-seed, fintech, cleantech and Web3

13. Outlast Fund: Europe Baltics and Nordics, pre-seed, B2B SaaS, AI, fintech and deep tech

14. United Founders: Europe’s founder-led early stage VC.

15. Onstage: Europe, pre-seed. “One pitch. Thousands of investors.”

Lastly, remember that “raising venture capital is the easiest thing a startup founder will ever do.” And, that fundraising is a means to an end, not a milestone or a goal.